Previous

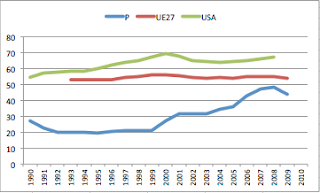

posts have discussed how strongly R&D spending changes between

different business sectors and different sizes of firms.

It

is obvious that Portugal and USA economies are very different, not only

in size, but specially in structure. The largest contributors to

R&D in USA are sectors not important in Portuguese economy. And

statistics about firms show a near total absence of very large firms

(larger than 10000 people, even larger than 5000 people) in Portugal.

These structural differences have obvious implications about R&D

expenses.

We

will consider only the effect of very large companies. We have shown

than firms larger than 10000 people contributed with half of the

business R&D in USA and they were much more committed to R&D

than the other firms. These kind of firms are not present in the

portuguese economy. In 2009 USA firms with more than 5000 people paid

and performed 137 b.USD of the total R&D bill (117 b for firms with

more than 10000 people). Basically there are not this kind of firms in

the portuguese economy. What

happens if that extra propensity to R&D disappears, assuming that their

contribution to the economy now would be through smaller companies

(less than 5000 people), with a propensity for business R&D around ⅓

of the propensity of very large companies?

If

these companies were not present in USA economy, but assuming the same

GDP, then business R&D would be smaller. From previous post, we

estimate that ⅔ of business R&D the larger firms (>5000 people).

This would mean ⅔ of 137 b.USD, or 91 b.USD - let’s assume a reduction

of 90 b.USD in USA business R&D (paid and performed by industry),

equivalent to 22.5% of R&D, and do a simple simulation.

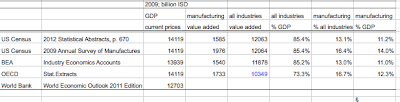

Total

USA R&D becomes 310 b.USD, 2.2% of GDP (not 2.9%), industry R&D

would be 1.4% (not 2.1%). In this scenario the original gap between

Portugal and USA (measured by R&D as % GDP) changes from 1.28% to

0.63% - half of the original one. And R&D performed by industry now

compares 0.72% GDP (Portugal) versus 1.43%GDP (USA).

Our

conclusion: around half of the gap between Portugal and USA is due to

the structural effect of the higher propensity of very large companies

to perform R&D.

This

exercise did not consider the structural effect of different business

structure, by industry sectors, between Portugal and USA economies. Of

course size and sector effects are not independent neither fully

cumulative. But an additional effect of lower R&D intensity sectors

in the portuguese economy is indeed reasonable.

So let’s simulate of reduction of 120 b.USD in USA business R&D, instead of 90. The new gap between R&D intensity is from 1.6% GDP (Portugal) to 2.0% (USA, instead of 2.9%), so 0.4% instead of 1.3%, and industry performed R&D gap is from 0.7% to 1.2% (instead of 2.0%), so 0.5% instead of 1.35%.

So let’s simulate of reduction of 120 b.USD in USA business R&D, instead of 90. The new gap between R&D intensity is from 1.6% GDP (Portugal) to 2.0% (USA, instead of 2.9%), so 0.4% instead of 1.3%, and industry performed R&D gap is from 0.7% to 1.2% (instead of 2.0%), so 0.5% instead of 1.35%.

Our

next conclusion: on a very preliminary basis, our guess of the

additional effect of R&D intensity per industry sectors suggests

that may be the “real” gap between Portugal and USA may be only one

third of the “formal” one.

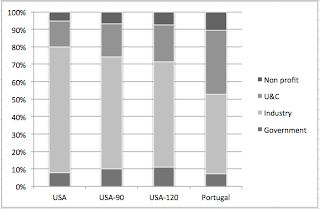

Next figure summarizes R&D % structure for these two scenarios (USA-90, USA-120) and the original ones for USA and Portugal.

Next figure summarizes R&D % structure for these two scenarios (USA-90, USA-120) and the original ones for USA and Portugal.